However, “severely financially distressed” businesses (those that experienced a gross receipt reduction of more than 90%) are eligible for the credit for all wages paid to employees, even if the business exceeds the 500 employee threshold.

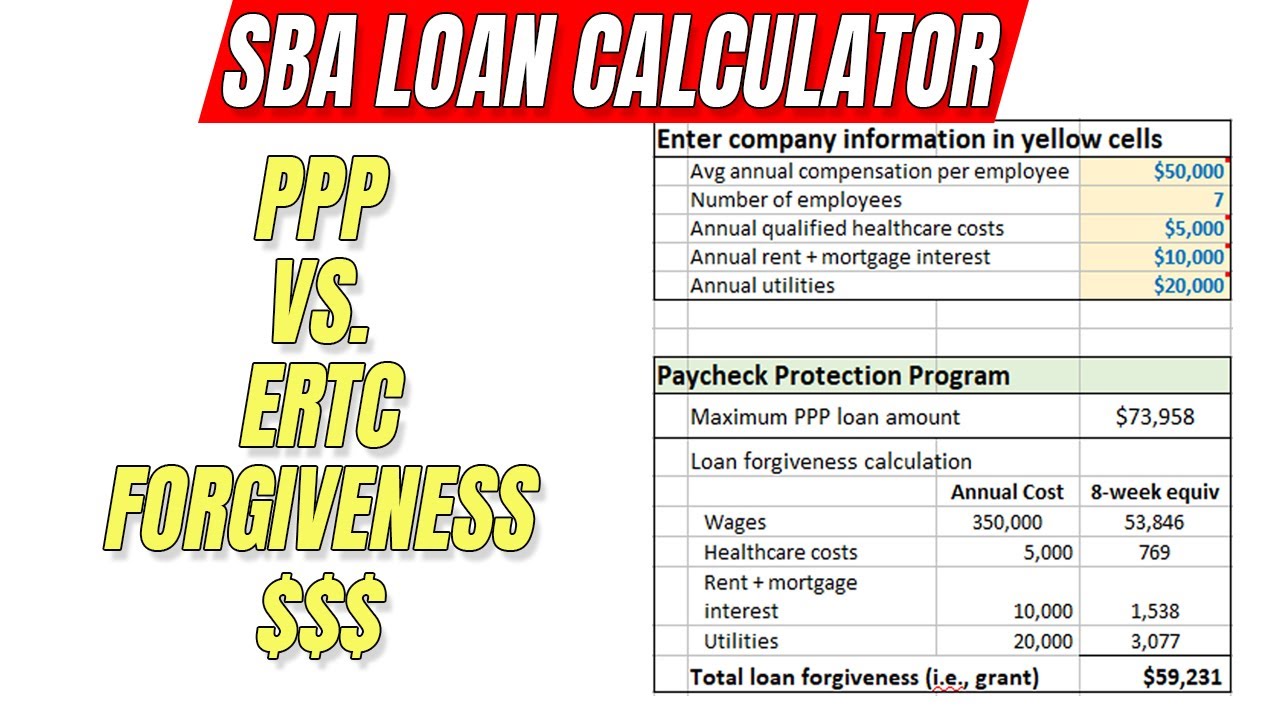

Credit is applied against payroll taxes equal to 70% of wages (wages up to $10,000) per employee per quarter (however, for certain businesses that began operating after February 15, 2020, the maximum for the business is $50,000 per quarter).Colleges, universities, and medical or hospital providers are eligible.The new legislation extends and expands the credit against payroll taxes for wages paid to employees from Mathrough December 31, 2021. Employee Retention Credit for shuttered businesses Paycheck Protection Program loan forgiveness calculatorĮnter your estimated expenses and staffing adjustments for the eight- to 24-week forgiveness period you select, beginning when you receive your loan.Ĭheck out SBA PPP loan forgiveness for information on applying for forgiveness through the new SBA portal or through your lender. (You have until the end of the forgiveness period you elect to restore full-time employment or salary for workers affected between February 15 and April 26, 2020.) See our PPP overview for more detail (PDF). Your loan forgiveness may be reduced according to the percentage (if any) by which you reduce staffing, or if you cut salaries and wages by more than 25% for employees who earn less than $100,000. Up to 40% of the forgiveness amount may be spent on mortgage interest, rent, utilities, supplier costs, property damage costs, worker protection expenses, other debt service or other operational expenses over the forgiveness period.Sixty percent of the forgiveness amount must be spent on payroll expenses, or the forgiveness amount will be reduced until payroll expenses equal 60% of it.Loan forgiveness is available for eligible costs paid or incurred during any period between eight and 24 weeks after receiving the loan.

Calculator: How much of your Paycheck Protection Program loan might be forgiven? This calculator can help you determine how much of your loan may be forgiven. While the SBA is no longer accepting new PPP loan applications, if you received a PPP loan, you may want to apply for loan forgiveness. Much of the 2021 relief flows from the Paycheck Protection Program (PPP), a new Second Draw Paycheck Protection Program (PPP2), and extensions of other benefits (tax credits and deferrals). The January 2021 federal relief provided a crucial economic lifeline to small businesses still reeling from the impacts of COVID-19. The SBA is no longer accepting new PPP loan applications.

0 kommentar(er)

0 kommentar(er)